By Bertha Vallejo and Erika Kraemer-Mbula

Dr. Bertha Vallejo is an OpenAIR QES fellow with the University of Johannesburg. She analyzes the adoption of Industry 4.0 technologies and its effects on local multinational’s counterparts. Prof. Erika Kraemer-Mbula leads the DST/NRF/Newton Fund Trilateral Chair in Transformative Innovation, the 4th Industrial Revolution, and Sustainable Development at the University of Johannesburg. Both Bertha and Erika are economists specialized in science, technology, and innovation (STI) policy analysis.

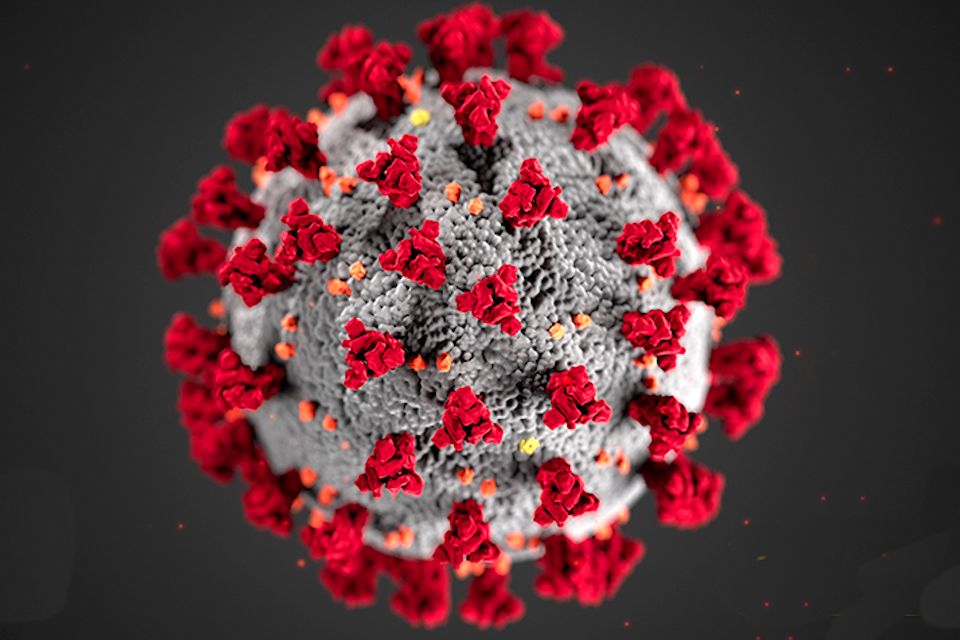

Although COVID-19 made its appearance slowly into our lives, it seems that it has taken us as an unannounced storm. We watched the news and saw how it spread in China, and then, it seems the rest of the world was just not prepared for what was coming. There was a general feeling of ‘that is not happening here,’ and a few weeks later, our societies and economies found themselves surprised, overwhelmed, and unprepared. The general immediate response taken by most countries in the world in the fight against COVID-19 has been the prioritization of human life over the economic impact of the measures applied; therefore ordering social isolation, the closing of borders (except for ‘critical’ items), and the suspension of all ‘non-essential’ activities have taken place as the standard measurements to slow down the number of contagious. Among the economic consequences of these measurements is the closing or slowing down of many factories around the world, an abrupt slowdown in inter-continental trade, and a decline in the supply of imported goods. The reality is that for micro- and small-sized businesses, prioritizing health over their economic needs is not a viable option, as they need trade to survive.

What does this mean for MSMEs1in already vulnerable economies?

When talking about Africa, as it is the case of many other countries in the South, we should highlight informality as a critical characteristic of its economic activities. About 80% of Africa’s employment is within the informal sector.2 This is particularly the case of micro- and small-sized businesses, which are mostly in the retail and wholesale business. In the case of Africa, about 80% of trade is with countries outside Africa, particularly with China. Due to COVID-19 effects in these countries, many medium-sized firms started to feel the impact of COVID-19 even before the appearance of first local cases. By early March, many firms in manufacturing have already closed, or slowed down, not because of the COVID-19 prevention measures imposed in their countries, but because their customers were not placing orders or they were not receiving production inputs.3 Sadly, the longer the lockdowns, the more the old economic disparities will be emphasized and reinforced.

Weathering the storm and looking at governments

Under these times of uncertainty, firms look upon their governments seeking for support in facing the upcoming economic challenges. In economies already struggling to reduce poverty and inequality, the current situation brings even more pressure on its already vulnerable economies. Seeking to support MSMEs, African governments have introduced a diversity of short-term financial rescue plans. These alternatives include tax reductions (like the reduction in VAT and PAYE in Kenya), grants, cash-payments (as in Nigeria), employment incentives, technical assistance, low-interest loans, and concessional financial.4Across the continent, local banks are restructuring loans, freezing interests, and facilitating micro-credits. In South Africa, a fund from the Ministry of Small Business Development has been released for those vendors of food and fishers (registration is needed).5 In solidarity with vulnerable businesses, international corporations, NGOs, and civil society have also joined efforts and offer some relief packages. Some examples of these alternatives are the channeling of donations (such as the Solidarity Fund in Pretoria, South Africa) and the Debt Relief Funds (South Africa). Additionally, private international companies are also organizing relief programs for those firms in Africa, and other countries in the South, with whom they have long-business relationships. An example of this is the 555,000EUR fund of Boehringer Ingelheim, a large German pharmaceutical, to Kenyan local social enterprises).6

Innovation as central to firm survival

In the last weeks, many firms are either reorganizing their business towards remote working, migrating towards e-commerce, or [temporal] shifting their production towards items with higher demand (i.e., ventilators, face masks). Many others, sadly, will simply be unable to survive the current circumstances. Now, more than ever, innovation is essential for micro and small businesses’ survival. Innovation is an essential driver of economic growth and development. It promotes changes by strengthening existing governance structures, promoting the inclusion of entrepreneurs and local stakeholders, the involvement of end-users, and coping with societal challenges. The ongoing locked outs have accelerated migration to online sales platforms is helping MSMEs to keep in business, to reach a broader range of clients, and to switch to cashless payment processes. Adaptation is a central quality of micro and small businesses. In the last weeks, we increasingly see small shops trying to keep their business alive using digital banking solutions like M-Pesa and PesaLink (in Kenya), MTN Mobile Money, Airtel Money Africa (India), or ChapChap (in Uganda). Another strategy that is increasingly adopted is that adopted by stores whose clients do not have access to smartphones is the use of SMS or simple phone calls (i.e., Ezey in Ethiopia). We also find improvised initiatives of firms advertising their products via Facebook, WhatsApp, and other Social Media platforms. ‘The corner store’ is taking advantage of its face-to-face interaction with its everyday customers (which are mostly people living nearby) and delivering its products by taking phone and SMS orders and accepting cash payments upon home delivery.

Digitalize, digitalize, digitalize

Africa’s telecommunications market has grown incredibly fast during the past ten years. Africa is the world leader in mobile money, with about 12% of adults (15+) with a registered mobile money account in 2019.7 About 24% of its population (i.e., 250 million adults) has used internet services on a mobile device by 2018.8 Digital infrastructure has facilitated the use of mobile money for local transactions, particularly favoring the inclusion of unbanked businesses and clients. South Africa is the leading country with the most developed telecommunication sector in the continent with four licensed mobile operators, namely MTN, Vodacom, Cell C, and 8ta, and sound internet coverage based on undersea data cables linking the country to the rest of the world.9 Kenya, Tanzania, Nigeria, and Ethiopia have also reached higher digital maturity than many others in the continent and setting examples with policies facilitating investment in digital trade.10Local online market initiatives adopting the Amazon model are examples of African claims for digital space and growing commercial partnerships. The growing African middle-class and increasing internet access has welcome local e-commerce initiatives such as Jumia (with coverage in 11 African countries) and Takealot in South Africa, Gobeba in Kenya, and Konga in Nigeria. Similar initiatives with a lower scale of retail companies are Addis Merkato (with about 15 suppliers) and EthioSuQ (with about 20 suppliers) in Ethiopia. Under COVID-19, many of these e-commerce platforms have restructured their portals to include only essential items (as listed by governments) as in the case of Jumia (who is struggling to survive under the current situation), or to add grocery items to their list of products (like Addis Merkato and Gobeba), at affordable prices, contactless deliveries, and online payments.11

Is this the way to go?

It seems that under COVID-19, the already strong call for the digitalization of businesses has become even stronger. Online sales have boosted in Africa, particularly in major cities. Those MSMEs capable of navigating and integrate into these electronic platforms may manage to survive. Unfortunately, many of these initiatives will not reach a large number of firms, particularly in the informal sector. Once again, differences in technological, social, and networking capabilities make the already existing inequality gap and digital divide even larger. Now more than ever, we urgently need well-structured cross-sectoral STI policies engaging local realities, local stakeholders, the private sector and the civil society under a social innovation lens. We need STI policy instruments that facilitate knowledge flows that contribute to build and strengthen capacity towards a systemic change. We require real knowledge of the strengths and weaknesses of our economic and social systems that take us away from generic statements with minimal reflections on how to strategize capacity strengthening most effectively towards reducing the existing knowledge gaps.

Disclaimer: The contents and results of this study do not necessarily reflect the views of the organizations to which the authors are affiliated. The usual caveats apply.

- Micro-Small- and Medium Enterprises (MSMEs).

- ILO. (2018) Women and men in the informal economy: A statistical picture (3rd ed.) Geneva: International Labour Office.

- Wambu, W. (2020). Companies’ output falls amid shortage of raw materials. Standard Digital. Retrieved from https://www.standardmedia.co.ke/business/article/2001368532/companies-output-falls-amid-shortage-of-raw-materials

- Tembo, D. (2020). Op-ed: The cost of coronavirus in Africa: What measures can leaders take? [Press release]. Retrieved from http://www.intracen.org/news/Op-ed-The-cost-of-coronavirus-in-Africa-What-measures-can-leaders-take/

- https://city press.news24.com/Business/covid-19-relief-for-informal-businesses-but theyll have-to-register-20200406

- Okuro, S. (2020, April 18th). COVID-19: SMEs in Kenya set to benefit from Sh63.9m relief fund. Standard Digital. Retrieved from https://www.standardmedia.co.ke/business/article/2001368393/sm s-in-kenya-set-to-benefit-from-sh63-9m-relief-fund

- GSMA. (2020b) State of the Industry Report on Mobile Money 2019. Retrieved from https://www.gsma.com/sotir/wp-content/uploads/2020/03/GSMA-State-of-the-Industry-Report-on-Mobile-Money-2019-Full-Report.pdf

- GSMA. (2020a). Mobile internet connectivity 2019. Sub-Saharan Africa Factsheet [Press release]. Retrieved from https://www.gsma.com/mobilefordevelopment/wp content/uploads/2019/07/Mobile-Internet-Connectivity-SSA Factsheet.pdf

- GSMA. (2020a). Mobile internet connectivity 2019. Sub-Saharan Africa Factsheet [Press release]. Retrieved from https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/07/Mobile-Internet-Connectivity-SSA-Factsheet.pdf

- AfricanCube. (2019) The Future of Africa’s Telecom Market. Retrieved from http://www.africancube.com/the-future-of-africas-telecom-market/

- Culliney, K. (2019, April 9). Jumia opens ‘essentials’ e-commerce platform in South Africa. Cosmeticsdesign-europe.com